Commonwealth Bank of Australia (CBA) is urgently investigating reports of duplicate transactions affecting customer accounts, leaving many concerned about their finances.

The bank acknowledged the issue on Saturday morning, assuring customers that it is working to resolve the problem and refund any associated fees.

Customers Raise Alarm Over Unexpected Charges

On Saturday, October 19, 2024, CBA customers began noticing unusual activity in their accounts, with many reporting duplicate charges for recent transactions. Social media platforms quickly filled with complaints from worried account holders, some of whom found their accounts overdrawn due to the error.

One customer reported seeing over $500 in duplicate debits, while another claimed to have noticed three copies of payments originally made on Thursday. The issue appears to be widespread, affecting various types of transactions and account holders across the country.

Bank’s Response and Ongoing Investigation

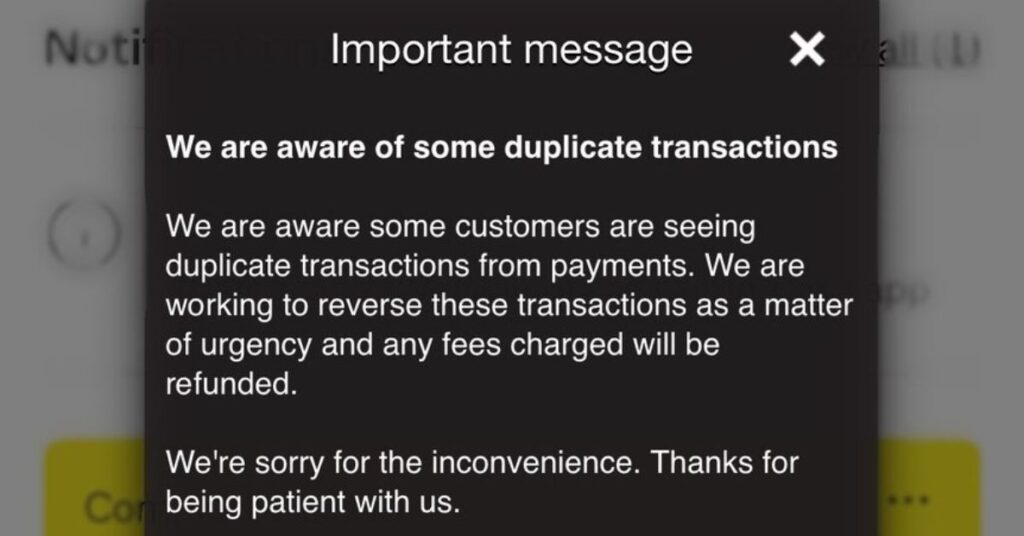

Commonwealth Bank promptly acknowledged the problem through its official social media channels. In a statement, the bank said:

“We are aware some customers are seeing duplicate transactions from payments. We are working to reverse these transactions as a matter of urgency and any fees charged will be refunded. We’re sorry for the inconvenience. Thanks for being patient with us.”

Also Read

The bank has not yet provided details on the cause of the glitch or an estimated timeframe for resolving the issue. However, they have assured customers that their teams are working diligently to address the problem and reverse the erroneous transactions.

Impact on Customers and Daily Life

The duplicate charges have caused significant stress and inconvenience for many CBA customers. Some have reported being unable to make essential purchases or pay bills due to their accounts being overdrawn. Others have expressed concern about potential long-term effects on their credit scores or financial planning.

One affected customer shared their experience: “My account is now overdrawn, and it double-charged me for the biggest transactions. Now I can’t make my payments tomorrow and can’t do anything today. I’m so stressed out.”

The timing of the glitch has been particularly problematic for some, with weekend plans and important payments being disrupted. Customers are urging the bank to provide more frequent updates and a clear timeline for resolution.

Broader Context of Banking Issues

This incident comes on the heels of recent technical difficulties experienced by other major Australian banks. Earlier in the week, Westpac and its subsidiaries, including St. George Bank, faced three consecutive days of outages affecting online and mobile banking services.

These recurring issues across different financial institutions have raised questions about the reliability of digital banking systems and the need for more robust infrastructure to prevent such disruptions.

Next Steps for Affected Customers

While Commonwealth Bank works to resolve the issue, affected customers are advised to:

- Keep track of their correct account balances

- Document any duplicate transactions or overdraft fees

- Avoid making large purchases or payments if possible

- Stay informed through official CBA communication channels

- Contact the bank’s customer service for urgent matters or hardship assistance

The bank has promised to refund any fees resulting from the duplicate transactions, but customers should remain vigilant and report any discrepancies they notice in their accounts.